Following Another Dow Plunge and All-Time Low Consumer Confidence, More Questions Than Ever Have Arisen About a Recession

After a slight surge that showed a bit of promise, Dow stocks appear to be dropping again to record numbers, leaving many consumers worried that a recession could happen sooner rather than later.

In the face of booming inflation that have left both home and gas prices sky high, the Dow Jones saw continuous losses for this week, dropping 1.6 percent – about the equivalent of 500 points. Markets have also taken a savage beating, thanks to consumer confidence dropping nearly six points to 98.7.

So what’s to come of this? Basically, with the benchmark index hitting its worst quarterly performance since early 2020 (during the beginning of COVID), there are concerns amongst many that the reported recession could happen much sooner than expected, which will make 2023 a really rough year for U.S. citizens.

Lynn Franco, senior director for the Conference Board, recently noted, “Consumers’ grimmer outlook was driven by increasing concerns about inflation, in particular rising gas and food prices. Expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as growing risk of recession by year’s end.”

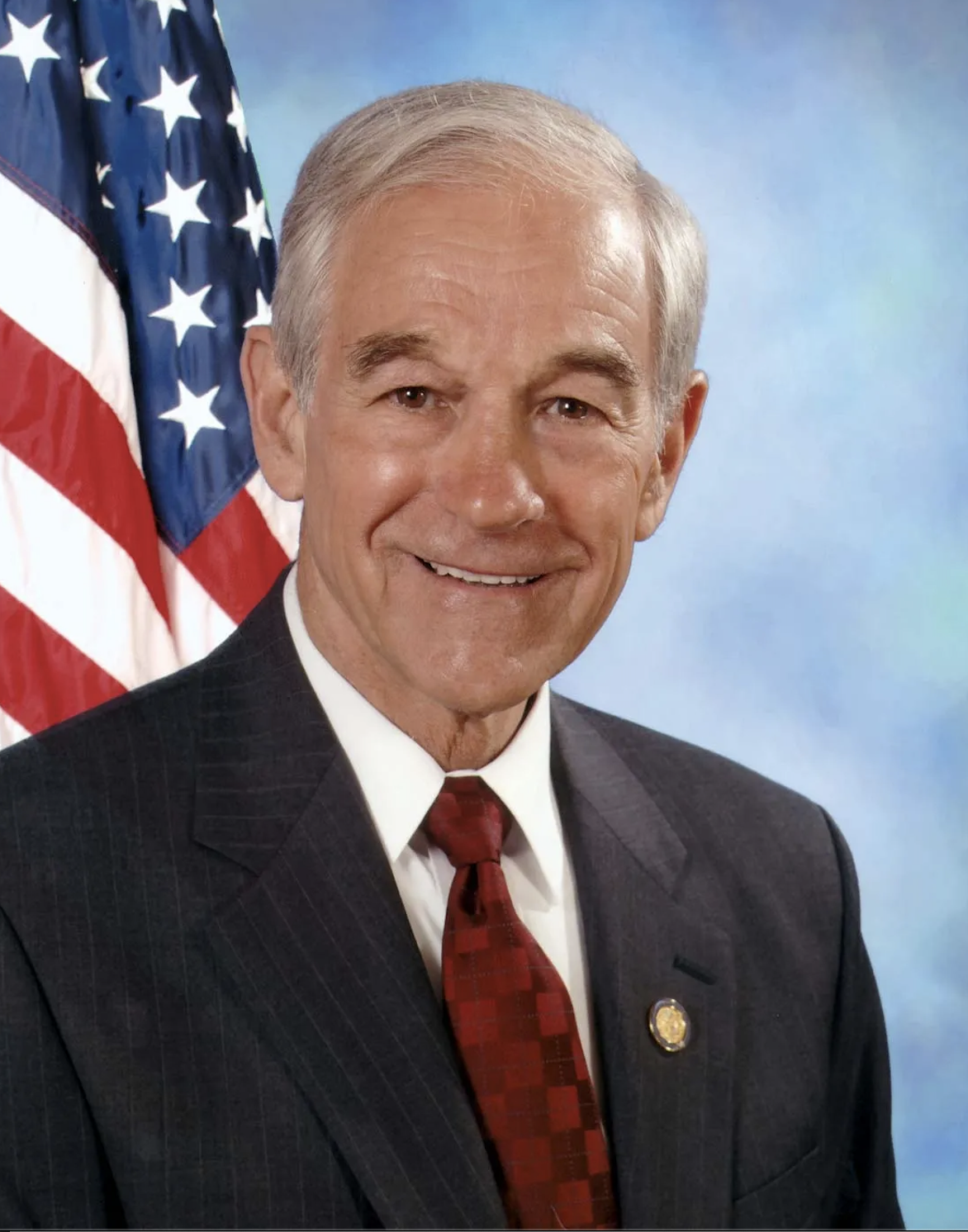

Joining us now to speak on Yellen’s somewhat inconclusive comments is a representative for Birch Gold Group, discussing the state of the economy further. (This could be either Brett Winterble or former Congressman Dr. Ron Paul.)

Q&A:

- There have been talks about recession happening before, but in the face of recent stock performance, do you believe this is likely to happen sooner than expected?

- How do you believe recession will affect U.S. citizens as a whole?

- It seems inflation continues to be on the rise, despite Biden and his government trying to do whatever it takes to bring it down. Do you see things getting better or worse in the months ahead?

- Is there any recommendations you would make for citizens to prepare for what’s to come with the recession? Or are they already seeing some of what’s to come with the effects of inflation?

- Considering you’re a representative of Birch Gold, you know quite a bit about the value of tangible metals, such as gold and silver. Would you say their value will continue to go strong in the face of continuing inflation and a possible recession? How highly would you recommend investing in these materials, as well as gold IRAs?

- Where can we learn more about Birch Gold Group, gold IRAs, and other services provided by Birch Gold.

- You can visit https://www.birchgold.com.

About Former Congressman Ron Paul:

Dr. Ron Paul is a former Republican congressman from the 22nd congressional district of Texas. Ron Paul espoused strong conservative and Libertarian positions, including maintaining a fiscally responsible government. Before his involvement in the political arena, Dr. Paul was a physician. He is active as a writer and spokesperson for organizations representing his core beliefs, including honest money. He is currently conducting a media tour for Birch Gold Group.

About Brett Winterble:

After spending nearly a decade with Rush Limbaugh as a Producer, Brett Winterble began his own show in 2008.

Brett currently hosts The Brett Winterble Show, heard Monday through Friday from 3-6 pm on News Talk 1110 & 99.3 WBT in Charlotte, North Carolina. Prior, Brett was heard on Sirius XM, plus 980 KFWB in Los Angeles and 760 KFMB in San Diego.

A lover of Current Events, Sports, Entertainment, and stories that really matter to the local audience, Brett has high energy and boundless curiosity.

He is a graduate of Emerson College and American Military University with degrees in Political Communication and Homeland Security/Intelligence Studies. Brett is married and has 2 teenagers plus a couple of cats, three birds, and some fish. His hobbies include travel, comedy writing, consuming motorsports, and barbecue.

CONTACT: Jerry McGlothlin of Special Guests 919-437-0001 jerry@specialguests.com