Intro: We have heard a lot about Stagflation lately, but what exactly is Stagflation, and should we be concerned about it? Our economic expert guest Jack Hanney says we should be concerned, very concerned. He goes so far as to say we are on the cusp of a “Volcker Moment,” reminiscent of the transition years between the Jimmy Carter and Reagan administrations. Jack Hanney is an economist and CEO of Patriot Gold Group. Welcome, Jack Hanney.

Talking Points:

- What exactly is Stagflation?

Answer: It’s what we saw during the Jimmy Carter years: A stagnant economy that ordinarily would cause prices to drop due to a poorer economy and less discretionary money, but instead, prices rose even during a stagnant economy, so it became the worst of both worlds: stagnation and inflation, thus the term, Stagflation.

- We see inflation rearing its ugly head again whenever we go to the grocery store or the gas pumps. Is either of those categories even included in government inflation statistics?

Answer: No, they are not. The excuse government officials give us is that those prices are too volatile, so they don’t count them. But I say this is all the more reason for them to be included—especially since apart from housing, I can hardly think of two more important areas in our life. We all need to feed our stomachs and in order to get around, we need to feed our gas tanks. Both are tough to do when wages rising with the rate of inflation.

- You mentioned housing. Let’s talk about this. Haven’t home building supplies gone through the roof? Is housing included in the government measurement of inflation?

Answer: Yes, housing is through the roof, and no, the government doesn’t include your home expense as part of their official inflation number.

- Sounds awfully convenient since government benefits are based on their inflation numbers, right?

Answer: Exactly. But fudging the figures, they pay out less of those nearly worthless fiat dollars they are printing.

- Let’s talk about those fiat dollars. What are they backed by gold or anything of value? What are they worth now and likely worth in the future?

Answer: They are not backed by gold or any other tangible assets. They are worth whatever you think of the government and politicians. Public opinion polls show that people think less than ever of their government overlords.

- So, if politicians and the paper money they represent are at an all time low, does that have anything to do with why the actual rate of inflation is rising so rapidly?

Answer: Absolutely. And we may see runaway inflation hit us in the face so quickly that we won’t know what hit us. And government raises to welfare benefits will not likely keep up with the rate of true inflation, triggering higher crime and a myriad of misery.

- What about all the shipping ports being backed up and prospects for the supply chain being so bleak? What impact will that have on the economy?

Answer: Between businesses suffering by not having the raw materials they need to survive, no less thrive, and with people not wanting to work, it’s a double whammy, likely to trigger all sorts of misery, with no relief, forcing us to live in a period of business stagnation, leading to Stagflation, not mere inflation.

- Tell us more about Stagflation.

Answer: Stagflation is the perfect storm of high gas prices, high grocery prices, high housing prices, and lower wages due to business stagnation.

- Then how will the average person hold the line on their existing lifestyles?

Answer: They won’t. They can’t. They’ll have to scale back—way back. And they will holler a lot in the process. Politicians will probably add more subsidies, only helping temporarily, since those subsidies will only trigger more inflation and the need for more subsidies to keep up with the higher prices. Eventually, the entire system will fall apart due to the government doing the opposite of what is needed: Rewarding laziness, punishing productivity, imposing newer and more creative ways to bog down businesses with health mandates, and imposing all sorts of new nonproductive intrusions on business and productivity.

- The Fed’s ULTRA loose monetary policy and politicians add in trillions more in pork, the FED is stuck between a rock and a hard place. If the FED doesn’t RAISE rates, hyperinflation will destroy wealth and the US Dollar. But if the FED raises rates, it will ruin the economy and stock market.

- We are on the cusp of a “Volcker Moment” where Fed Chair Paul Volcker hiked rates to tackle inflation in 1980-1982 resulting in a double dip recession, ONLY this time the GLOBAL DEBT is THREE TIMES HIGHER than it was in the 1970’s and “anti-inflationary policy will lead to a CATASTROPHIC depression rather than merely a severe recession.

- You and your company are firm believers in holding tangible assets like gold or silver. Tell us about your company, Patriot Gold Group, and where may we get more information on acquiring tangible assets.

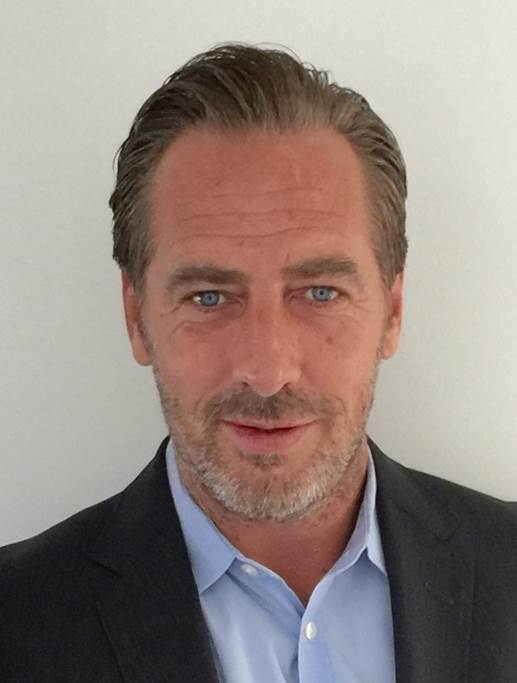

ABOUT JACK HANNEY…

Jack Hanney has been in the financial markets for 25+ years and is widely heralded as an expert in his field.

Jack was born and raised in Westchester County, NY. Jack subscribed to The Wall Street Journal at the age of 14 and moved to California in his early 20’s to study under Investor’s Business Daily founder William O’Neill.

Jack Hanney was the General Manager and Director of Sales at several algorithmic automated trading companies trading the futures and commodities markets, working with Introducing Brokers out of Chicago, Geneva, and NYC. Jack was recruited by several tech startups and made a name for himself at Infosearch Media, Virtumundo, and The Design People before returning to Finance. Jack passed on Morgan Stanley, and other reputable, prestigious Brokerage firms to be a CFP in their Wealth Management Divisions and opted for a position as Senior Executive Trader with MG Private Client Services. He spent four years 2010-2014.

Jack Hanney had spent two years as Director of Trading, Executive Vice President of WDM overseeing the Retail Division before cofounding Patriot Gold Group a collective of Industry-Leading Experts bringing their clients Investor Direct Pricing and superior customer service.

Jack has written over half a billion dollars in business and trades, maintaining outstanding relationships with his clients at Patriot Gold Group (PGG), where he is a senior partner. Jack resides in Los Angeles, California with his wife Amy and is the proud father of his two daughters, Kate, age 13 and Luna age 21 & their two dogs Roxy & Daisy.

CONTACT: To schedule an interview with Jack Hanney, email jerry.specialguests@gmail.com or call Celinda Hawkins at (432) 349-2736.

100 Guests/Topics: https://specialguests.com/guests-topics/